OPPORTUNITIES

PAYMENT

-Crypto not used for everyday purchases

-Many barriers for user adoption

-Merchants don't accept crypto due to volatility

-Complicated user experience

- DEFI

Lack of Smart financial products for retail users - CROSS-BORDER

Traditional overseas remittances, cross-border payments and foreign exchange are inefficient - DIGITAL BANK

Many industries such as Cannabis-related businesses can’t get bank accounts and therefore are unable to get access to any further services of traditional banks, i.e. payment, transfer, trade finance, loan, acceptance bill, supply chain financing, factoring financing, etc.

Market Scale

$29 Billion Global Cannabis Market The legal cannabis market was worth $10. 3 billion in 2018. Total legal sales of cannabis are projected to grow at 16%CAGR over the next six years, reaching $29 billion by 2025

Cross-border Payment

With the higher frequency of cross-border payments, more and more products are sold to foreign buyers, various E-platforms and self-built websites. But for Asian and Lat-Am sellers, it has become increasingly difficult to set up offshore companies or open overseas accounts for their remittance needs. Mainland Chinese seller is a good example. Some resort to underground forex brokers that are unregulated and unsafe, while others struggle to use third party companies to circumvent the FX control

RMB Exchange/Remittance

Under the existing foreign exchange control system, the procedures for RMB exchange/remittance are cumbersome and time-consuming. A lot of cross-border ecommerce sellers resort to underground forex brokers

Cross-border Remittance

Traditional TT remittances take several days and are inefficient. Connecting buyers from currency control countries with luxury items sellers such as car dealerships by offering same day clearing will revolutionize the shopping and remittance experience for buyers and merchants

PARTNERSHIP

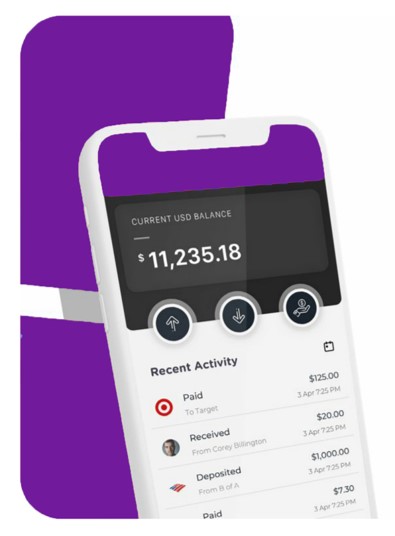

mintPay

Contact Us

Email:

support@mintpay.io